Home

Hedge Fund Guided Portfolio Solution

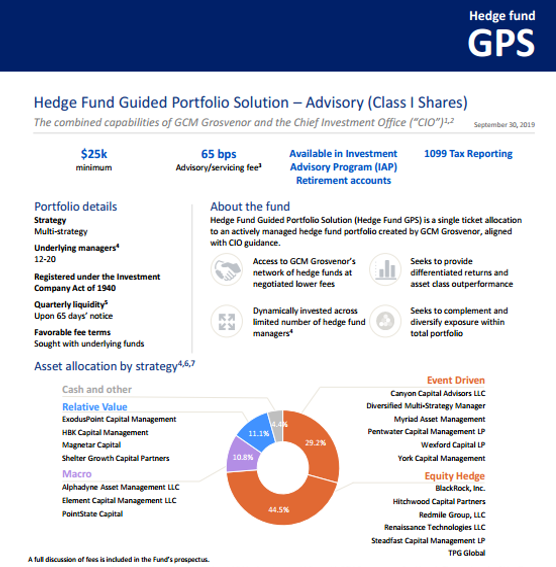

Hedge Fund Guided Portfolio Solution (“Hedge Fund GPS”) is a single ticket allocation to an actively managed, multi-strategy hedge fund portfolio created by GCM Grosvenor.

![]() Access to lower fees obtained by GCM Grosvenor from its network of hedge funds

Access to lower fees obtained by GCM Grosvenor from its network of hedge funds

![]() Dynamically invested across limited number of hedge fund managers1

Dynamically invested across limited number of hedge fund managers1

![]() Seeks to provide differentiated returns and asset class outperformance

Seeks to provide differentiated returns and asset class outperformance

![]() Seeks to complement and diversify exposure within total portfolio

Seeks to complement and diversify exposure within total portfolio

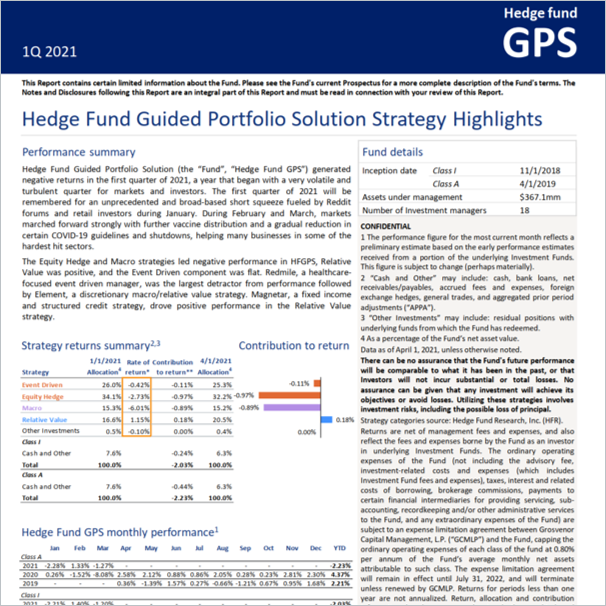

PERFORMANCE2,3

The Fund’s investment objective is to seek absolute returns with low to moderate volatility and with minimal correlation to the global equity and fixed income markets while preserving capital.

| October 2024 | September 2024 | QTD | YTD | |

| Brokerage (Class A Shares) Inception Date: April 2019 | 0.78% | 1.32% | 0.78% | 9.12% |

| Advisory (Class I Shares) Inception Date: November 2018 | 0.85% | 1.38% | 0.85% | 9.86% |

| HFRI Fund Weighted Composite4 | -0.73% | 1.37% | -0.73% | 7.43% |

Annualized Total Returns as of October 31, 2024

| 1 Year | 5 Year | 10 Year | Since Inception5 | |

| Brokerage (Class A Shares) | 13.16% | 2.21% | N/A | 1.90% |

| Advisory (Class I Shares) | 14.08% | 3.04% | N/A | 2.92% |

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than that quoted. To obtain current to the most recent month-end performance, call 1-855-426-9321, Option 3. Month-end performance is typically updated on the 9th business day of the following month.

Literature

Notes and Disclosures

1 Utilizing these strategies involves investment risks, including the possible loss of principal.

2 No assurance can be given that any investment will achieve its objectives or avoid losses. Utilizing these strategies involves investment risks, including the possible loss of principal. Returns are net of management fees and expenses, and also reflect the expenses borne by the “Fund” as an investor in underlying investment funds. Investors purchasing may be charged a transaction fee on the investor’s aggregate purchase, assessed by a financial intermediary and in addition to the investor’s aggregate purchase. The Fund offers Class A Shares and Class I Shares, which are subject to different fees and expenses and will have different investment performance as a result. Class A Shares and Class I Shares are available only through specific distribution channels, and a specific share class may not be available to all investors. The Fund pays a 55 bps investment advisory fee to GCMLP and a 10 bps administrative services and sub-accounting fee to Merrill Lynch based on the assets of both Class A Shares and Class I Shares, subject to some exclusions. In connection with Class A Shares, the Fund pays Merrill Lynch a 75 bps distribution and service fee. Fees and expenses are more fully described in the Fund’s prospectus. The ordinary operating expenses of the Fund (not including the advisory fee, investment-related costs and expenses (which includes investment fund fees and expenses), taxes, interest and related costs of borrowing, brokerage commissions, payments to certain financial intermediaries for providing servicing, sub-accounting, recordkeeping and/or other administrative services to the Fund and any extraordinary expenses of the Fund) are subject to an expense limitation and reimbursement agreement between GCMLP and the Fund, capping the ordinary operating expenses of each share class of the fund at 0.80% per annum of the Fund’s average monthly net assets attributable to such class. The agreement will remain in effect until July 31, 2025, and will terminate unless renewed by GCMLP. Returns for periods less than one year are not annualized. Returns have been prepared using both unaudited and audited financial data, if available at the time, and valuations provided by the underlying Investment Funds. Valuations based upon unaudited or estimated reports from the underlying investment funds may be subject to later adjustments that may be both material and adverse.

3 The performance figure for the most recent month reflects a preliminary estimate based on the early performance estimates received from a portion of the underlying Portfolio Funds. This figure is subject to change (perhaps materially).

4 The HFRI Fund Weighted Composite Index includes more than 2000 constituent domestic and offshore funds (no funds of funds are included). Funds must have AUM of $50M and have been actively trading for 12 months. This index is calculated three times per month and rebalanced monthly.

5 Since inception performance for Class A Shares begins April 2019. Since inception performance for Class I Shares begins November 2018.

Data source: Hedge Fund Research (HFR).

Grosvenor Capital Management, L.P. (“GCMLP”) serves as investment adviser of the Fund. The Fund is registered under the Investment Company Act of 1940 (“1940 Act”) as a closed-end management investment company. The Fund invests substantially all of its assets in investment funds (“Investment Funds”) managed by third-party investment management firms (“Investment Managers”). GCMLP, together with its affiliates comprise GCM Grosvenor (NASDAQ: GCMG). GCM Grosvenor is a global alternative asset management solutions provider across private equity, infrastructure, real estate, credit, and absolute return investment strategies.

For any questions, please contact GCM Grosvenor Investor Relations at [email protected].

This website is general in nature and does not take into account any investor’s particular circumstances. Access to this website should not be considered a recommendation with respect to the purchase, sale, holding or management of securities or other assets. This website is neither an offer to sell, nor a solicitation of an offer to buy shares of the Fund (“Shares”) or interests in any Investment Fund in which the Fund invests. An offer to sell, or a solicitation of an offer to buy, Shares of the Fund, if made, must be preceded or accompanied by the Fund’s current Prospectus (which, among other things, discusses certain risks and other special considerations associated with an investment in the Fund). Before investing in the Fund, you should carefully review the Fund’s current Prospectus. Each prospective investor should consult its own attorney, business advisor and tax advisor as legal, business, tax and related matters concerning an investment in the Fund.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS, AND THE PERFORMANCE OF THE FUND COULD BE VOLATILE. AN INVESTMENT IN THE FUND IS SPECULATIVE AND INVOLVES SUBSTANTIAL RISK (INCLUDING THE POSSIBLE LOSS OF THE ENTIRE AMOUNT INVESTED). NO ASSURANCE CAN BE GIVEN THAT THE FUND WILL ACHIEVE ITS OBJECTIVES OR AVOID SIGNIFICANT LOSSES.

YOU SHOULD NOT INVEST IN THE FUND UNLESS YOU HAVE NO NEED FOR LIQUIDITY WITH RESPECT TO SUCH INVESTMENT, YOU ARE FULLY ABLE TO BEAR THE FINANCIAL RISKS OF SUCH INVESTMENT FOR AN INDEFINITE PERIOD OF TIME AND YOU ARE FULLY ABLE TO SUSTAIN THE POSSIBLE LOSS OF THE ENTIRE INVESTMENT. YOU SHOULD CONSIDER AN INVESTMENT IN THE FUND AS A LONG-TERM INVESTMENT THAT IS APPROPRIATE ONLY FOR A LIMITED PORTION OF YOUR OVERALL PORTFOLIO.

In reviewing the performance of the Fund or any Investment Fund, you should not consider the index shown to be a performance benchmark. The index performance is provided solely as an indication of the performance of capital markets in general. Index figures may include “estimated” figures in circumstances where “final” figures are not yet available.

Set forth below are general categories of risks that apply to investing in the Fund. The risks that apply to investing in the Fund are described in greater detail in the Fund’s current Prospectus.

Market Risks – the risks that economic and market conditions and factors may materially adversely affect the value of the Fund’s investments.

Illiquidity Risks – the risks arising from the fact that Shares are not traded on any securities exchange or other market and are subject to substantial restrictions on transfer; although the Fund may offer to repurchase Shares from time to time, a shareholder may not be able to liquidate its Shares of the Fund for an extended period of time.

Strategy Risks – the risks associated with the possible failure of GCMLP’s asset allocation methodology, investment strategies, or techniques used by GCMLP or an Investment Manager.

Manager Risks – the risks associated with the Fund’s investments with Investment Managers.

Structural and Operational Risks – the risks arising from the organizational structure and operative terms of the Fund and the Investment Funds.

Cybersecurity Risks – technology used by the Fund and by its service providers could be compromised by unauthorized third parties.

Foreign Investment Risks – the risks of investing in non-U.S. investment products and non-U.S. Dollar currencies.

Leverage Risks – the risks of using leverage, which magnifies the volatility of changes in the value of an investment, including losses.

Valuation Risks – the risks relating to GCMLP’s reliance on Investment Managers to accurately value the financial instruments in the Investment Funds they manage.

Institutional Risks – the risks that the Fund could incur losses due to failures of counterparties and other financial institutions.

Regulatory Risks – the risks associated with investing both in unregulated entities and in unregistered offerings of securities. Investment Funds generally will not be registered as investment companies under the 1940 Act. Therefore, the Fund, as a direct or indirect investor in Investment Funds, will not have the benefit of the protections afforded by the 1940 Act to investors in registered investment companies.

Tax Risks – the tax risks and special tax considerations arising from the operation of and investment in pooled investment vehicles such as the Fund and the Investment Funds.

GCMLP and its affiliates have not independently verified third-party information included in this website and make no representation or warranty as to its accuracy or completeness.

This website does not make any recommendations regarding specific securities, investment strategies, industries or sectors. Risk management, diversification and due diligence processes seek to mitigate, but cannot eliminate risk, nor do they imply low risk. To the extent this website contains “forward-looking” statements, including within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, such statements represent GCMLP’s good-faith expectations concerning future actions, events or conditions, and can never be viewed as indications of whether particular actions, events or conditions will occur. All expressions of opinion are subject to change without notice in reaction to shifting market, economic or other conditions. GCMLP does not give any assurance that it will achieve any of its expectations.

GCMLP and/or certain qualified officers and employees of GCMLP and its affiliates (together with members of their families, “GCM Grosvenor Personnel”) currently have investments in the Fund and additional GCM Grosvenor Personnel may invest in the Fund in the future. Except as otherwise expressly contemplated by the Fund’s governing documents, however, no such person is required to maintain an investment in the Fund.

GCM Grosvenor®, Grosvenor®, and Grosvenor Capital Management® are trademarks of Grosvenor Capital Management, L.P. and its affiliated entities. ©2024 Grosvenor Capital Management, L.P. All rights reserved. Grosvenor Capital Management, L.P. is a member of the National Futures Association.

GRV Securities LLC (“GSLLC”), a member of the Financial Industry Regulatory Authority, Inc. and an affiliate of GCMLP, serves as the distributor of the Fund. GSLLC does not offer any investment products other than interests in certain funds managed by GCMLP and/or its affiliates. Neither GCMLP nor any of its affiliates acts as agent/broker for prospective investors or any Investment Fund.